Arizona continues to attract investors looking beyond city limits. With wide open land, lower purchase prices, and long term development potential, rural areas across the state are drawing attention from buyers who want more control, space, and upside. While urban markets can feel crowded and expensive, rural regions offer a different path to growth.

Rural property investment in Arizona appeals to investors who value flexibility. Some are focused on land appreciation. Others plan to build rental homes, agricultural operations, or future residential developments. Arizona’s population growth, infrastructure expansion, and strong demand for housing continue to support this interest.

That said, rural investments are not without challenges. Access to utilities, zoning regulations, and resale timelines differ significantly from city properties. Understanding both the upside and the risks is essential before committing capital.

Why Investors Are Looking at Rural Arizona Properties

One of the biggest advantages of rural property investment in Arizona is affordability. Compared to Phoenix, Scottsdale, or Tucson, rural land prices remain accessible. Investors can often acquire larger parcels for the same price as a small urban lot.

Another draw is flexibility. Rural zoning typically allows more freedom in how land is used. This can include single family homes, manufactured housing, agricultural use, or long term land holding strategies.

Arizona’s steady population growth also plays a role. As cities expand outward, rural areas near highways and developing corridors become attractive for future buyers. Investors who enter early can benefit from appreciation as demand increases.

Climate is another factor. Arizona’s dry weather reduces many maintenance issues common in other states, making land ownership simpler and more predictable over time.

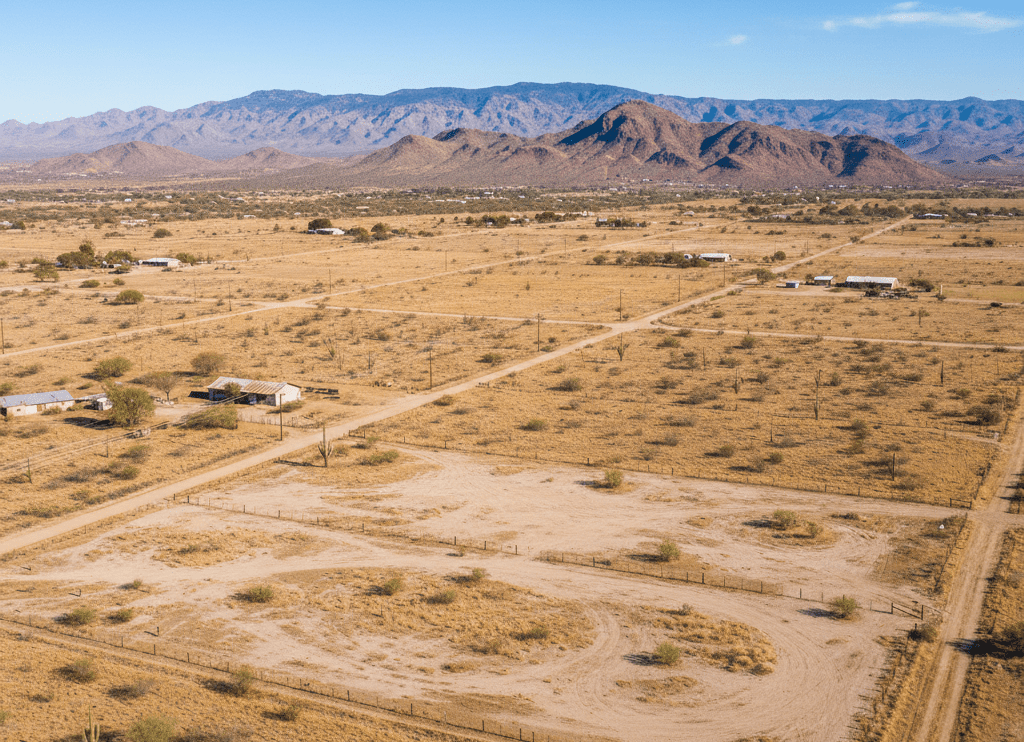

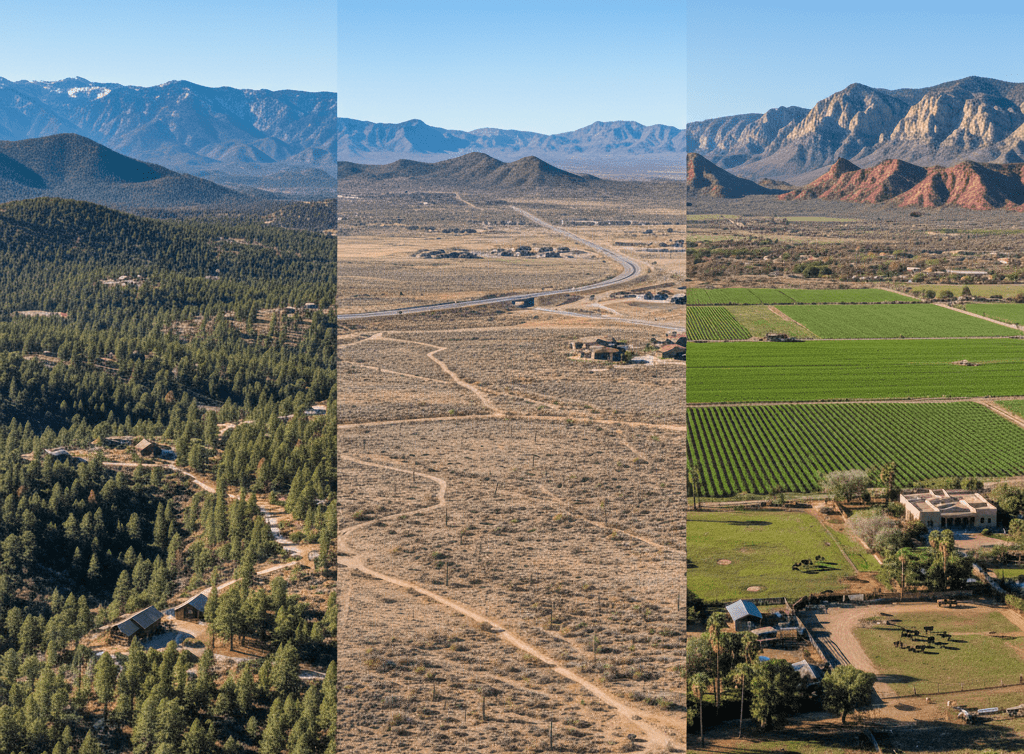

Popular Areas for Rural Property Investment in Arizona

Not all rural locations offer the same potential. Successful rural property investment in Arizona depends heavily on location and future growth patterns.

Northern Arizona attracts buyers seeking recreational land and vacation rentals. Areas near Flagstaff and smaller mountain towns appeal to seasonal residents and outdoor enthusiasts.

Southern Arizona offers agricultural opportunities, especially around Cochise and Santa Cruz counties. These regions support farming, ranching, and long term land appreciation.

Central Arizona, outside metro Phoenix, is gaining attention as infrastructure expands. Investors often monitor areas near planned highways, logistics hubs, and expanding suburbs.

Understanding local development plans and access to transportation is critical when selecting rural properties.

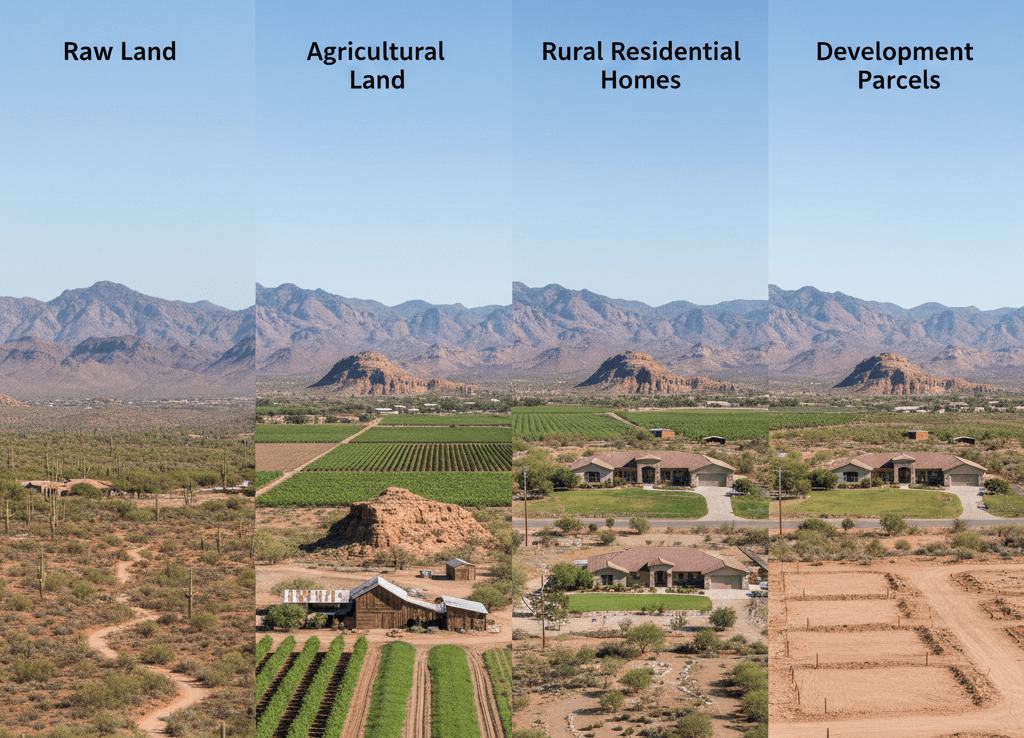

Types of Rural Properties Investors Can Buy

Rural property investment in Arizona covers a wide range of property types, each with different risk and return profiles.

Raw Land

Undeveloped land is often the most affordable option. It offers long term appreciation potential but may require patience. Investors should verify access, zoning, and utility availability before purchasing.

Agricultural Land

Farmland and ranch properties can produce income while appreciating in value. These investments often require operational knowledge but offer tax and income advantages.

Rural Residential Homes

Homes located outside city limits can generate rental income or serve as future resale properties. Demand often comes from buyers seeking space, privacy, or lower costs.

Development Parcels

Some investors target rural land suitable for subdivision or future residential development. These properties require deeper research but can produce strong returns when timed correctly.

Key Financial Advantages of Rural Investing

Lower acquisition costs are a major reason rural property investment in Arizona attracts new investors. Entry prices are often significantly lower than city properties, reducing upfront risk.

Property taxes in rural areas also tend to be lower. This helps keep holding costs manageable during longer investment timelines.

Investors can diversify portfolios by balancing urban rental properties with rural land holdings. This reduces exposure to market volatility in a single segment.

Some investors also benefit from owner financing opportunities, which are more common in rural land transactions and provide flexible purchase terms.

Risks to Consider Before Buying Rural Property

Despite the benefits, rural property investment in Arizona carries specific risks that investors must address.

Limited Utilities

Many rural parcels lack access to water, electricity, or sewer systems. Extending utilities can be expensive and impact profitability.

Zoning and Restrictions

County zoning rules vary widely. Some properties have restrictions that limit building size, property use, or subdivision options.

Liquidity Challenges

Rural properties often take longer to sell. Investors should be prepared for extended holding periods before realizing returns.

Environmental Factors

Flood zones, soil quality, and access roads should be evaluated carefully. Due diligence is critical in rural transactions.

Understanding the Buying Process for Rural Properties

The buying process for rural property investment in Arizona differs from urban purchases. Buyers should work with professionals who understand land transactions, surveys, and county regulations.

Midway through the process, many investors consult resources like the step by step guide to closing on a home in Arizona to understand inspections, title requirements, and closing timelines. Rural closings often involve additional documentation, including access easements and water rights verification.

Financing options may also differ. Some lenders require larger down payments or offer specialized land loans.

Many investors review a step by step guide to closing on a home in Arizona to better understand inspections, title requirements, and county specific closing steps for rural properties.

Rental and Income Opportunities in Rural Arizona

While some rural investments focus on appreciation, income strategies are also available.

Short term rentals near outdoor attractions or tourist destinations can generate seasonal income. Long term rentals appeal to residents seeking affordable housing outside city centers.

Some investors combine rural land ownership with mobile homes or manufactured housing to create affordable rental solutions.

Others explore agricultural leasing, solar land leasing, or storage uses depending on location and zoning.

Comparing Rural and Urban Investment Performance

Rural property investment in Arizona typically offers slower appreciation than prime urban locations, but with lower competition and entry costs.

Urban properties often provide faster liquidity and higher rental demand, while rural investments reward patience and strategic planning.

Investors focused on long term growth often blend both approaches, using rural land as a hedge against rising city prices.

Many investors balance rural land holdings with Phoenix real estate investment to maintain both short term income and long term appreciation.

Understanding market cycles and population trends helps investors decide when rural assets make sense within their portfolio.

Market Trends Supporting Rural Arizona Investments

Arizona’s housing demand continues to push outward from metro areas. Infrastructure improvements, remote work flexibility, and affordability pressures support rural expansion.

Investors studying Arizona investment patterns often review data from regional investment reports and guides such as investors guide to off market rental properties in Phoenix to understand how urban demand influences surrounding rural areas.

As cities grow, nearby rural properties become candidates for future residential and mixed use development.

Investors tracking demand shifts often compare rural land opportunities with off market rental properties in Phoenix to see how city pressure pushes development outward.

Working With Local Experts

Local expertise is essential for successful rural property investment in Arizona. Agents familiar with land transactions help identify properties with realistic development potential.

Heritage Capital and Real Estate works with buyers and investors navigating both urban and rural markets. Their understanding of zoning, financing, and long term planning helps reduce costly mistakes.

Experienced professionals also assist with negotiations, inspections, and future exit strategies.

Long Term Returns and Exit Strategies

Returns from rural property investment in Arizona vary based on strategy. Some investors focus on appreciation and sell when development reaches their area.

Others generate income through leasing or rental use while holding land long term.

Clear exit planning is essential. Investors should define whether they plan to sell, develop, or pass properties down as legacy assets.

Timing exits with infrastructure expansion or population growth often produces the strongest returns.

FAQs:

Is rural property a good investment in Arizona?

Yes, rural properties can offer strong long term potential when purchased with proper research and realistic timelines.

Can I finance rural land purchases?

Financing is available, but requirements often differ from traditional home loans and may require higher down payments.

Are rural properties harder to resell?

They can take longer to sell, which is why patience and clear exit strategies are important.

Do rural properties generate rental income?

Some do, especially rural homes or properties near tourist destinations, but income potential varies by location.

What should I check before buying rural land?

Access, zoning, utilities, flood zones, and county regulations should all be verified during due diligence.

Conclusion

Rural property investment in Arizona offers a unique blend of affordability, flexibility, and long term growth potential. While it requires more research and patience than urban investing, the rewards can be significant for investors who plan carefully.

By understanding location trends, managing risks, and working with knowledgeable professionals, investors can position rural assets as a valuable part of a diversified real estate portfolio.

Arizona’s continued growth and expanding infrastructure suggest that rural opportunities will remain relevant for years to come.