Arizona has long been a popular destination for both renters and homebuyers seeking sunny weather, affordable living compared to coastal cities, and diverse lifestyle options. For many newcomers, deciding whether to rent or buy is one of the first major financial choices they face. The choice is not just about cost but also lifestyle, flexibility, and long-term investment goals. Understanding the nuances of renting vs buying in Arizona can help you make an informed decision that aligns with your financial situation and personal goals.

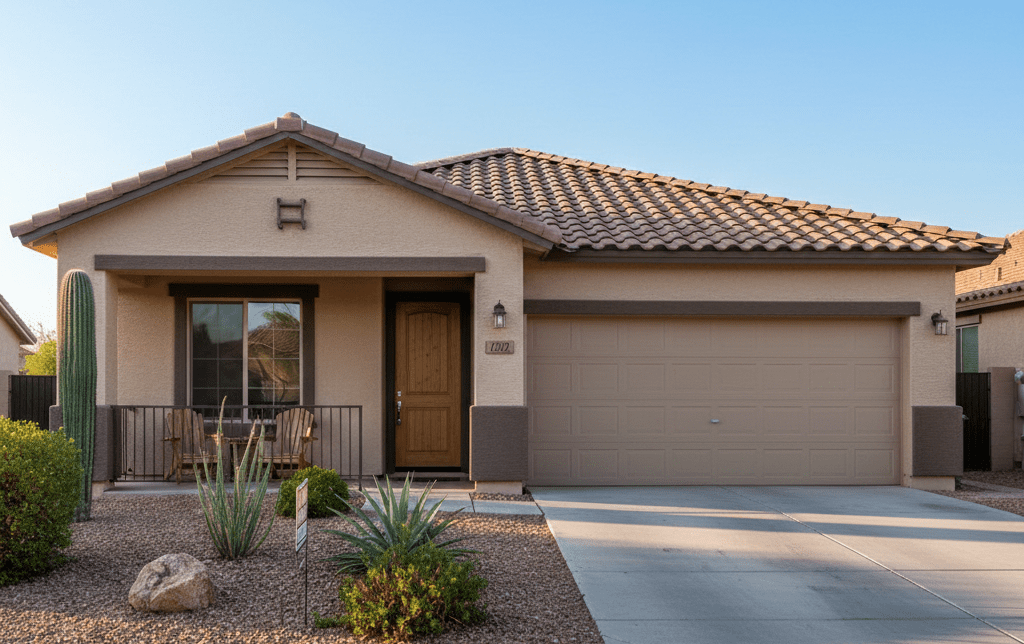

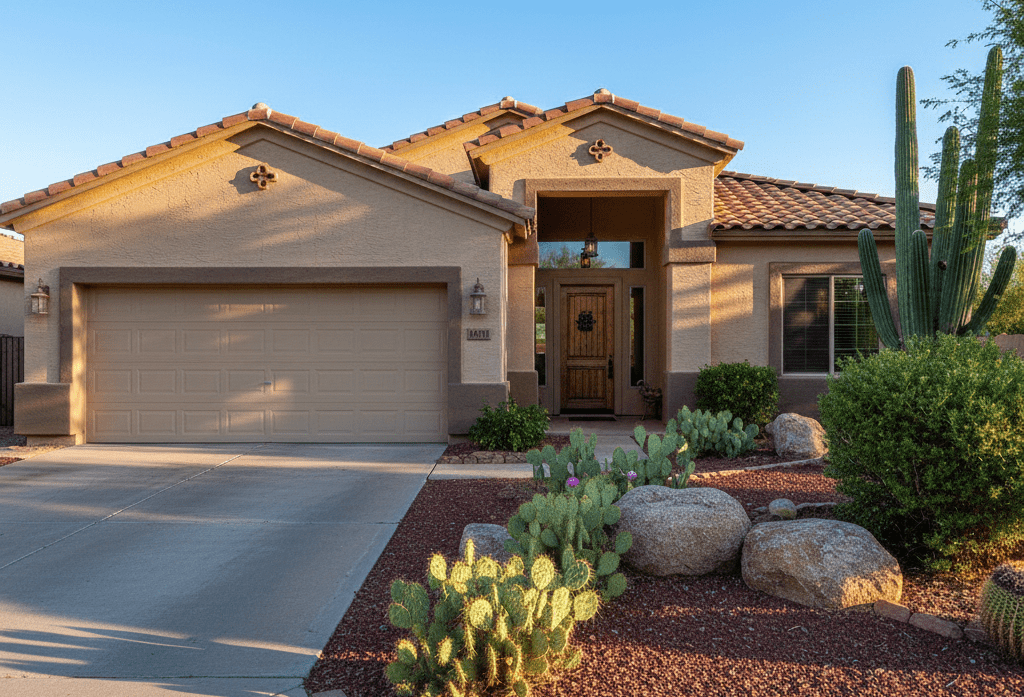

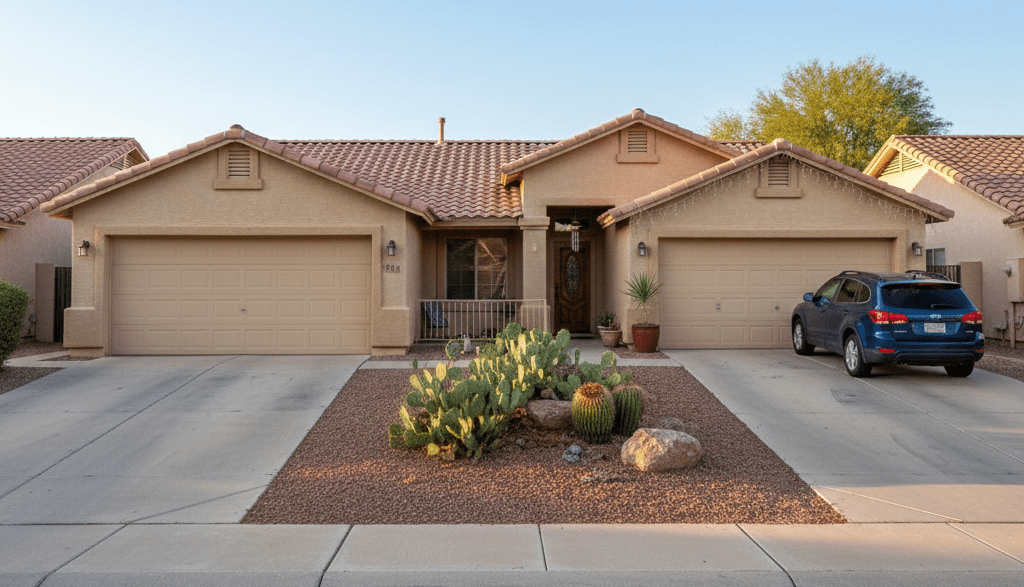

Arizona’s real estate market offers a variety of options, from single-family homes in suburban neighborhoods to modern apartments in city centers. With rapid population growth in cities like Phoenix, Tucson, and Scottsdale, both rental and purchase markets are evolving quickly. Each path, renting or buying, has unique advantages and drawbacks that are worth considering before committing.

Costs of Renting in Arizona

Renting in Arizona can offer flexibility and lower upfront costs, making it an attractive option for those who are new to the state or uncertain about long-term plans. Security deposits, first month’s rent, and minimal maintenance responsibilities make renting financially accessible. Renters are not responsible for property taxes, homeowner insurance, or major repairs, which can be significant in areas with extreme temperatures.

Understanding rental affordability requires looking at local income levels. According to U.S. Census housing and income data for Arizona, median household incomes and rent prices show that Arizona remains an accessible market for many renters.

Renting also allows residents to live in neighborhoods they might not be able to afford to buy in immediately. Urban areas with job proximity or access to amenities are easier to access through rental options. Maintenance is usually handled by the landlord or property management company, which eliminates concerns over unexpected repair costs.

Benefits of Renting

One of the key benefits of renting is mobility. For those considering career changes, temporary work assignments, or lifestyle exploration, renting allows flexibility without the long-term commitment of a mortgage. Many landlords in Arizona offer furnished or semi-furnished units, which can further reduce upfront costs and simplify moving.

Renters can also take advantage of community amenities such as pools, gyms, and shared outdoor spaces without the added costs of ownership. For families and individuals prioritizing lifestyle over equity building, renting in Arizona can provide convenience and cost efficiency.

Another consideration is market volatility. Renters are insulated from fluctuations in property value and can relocate more easily if prices or neighborhood dynamics change. Understanding these factors is essential when weighing renting vs buying in Arizona.

Costs of Buying a Home in Arizona

Purchasing a home in Arizona is a major financial commitment, requiring significant upfront costs. Buyers must cover down payments, closing costs, inspections, and often homeowners association fees. The step by step guide to closing on a home in Arizona provides a detailed roadmap of these costs, highlighting considerations such as title insurance, appraisal fees, and escrow costs.

Mortgage payments include principal and interest, along with property taxes, homeowner insurance, and sometimes private mortgage insurance. In Arizona, property taxes are relatively moderate compared to national averages, but they still contribute to monthly expenses. Buyers should also budget for long-term maintenance, especially in areas with extreme heat that can affect roofs, air conditioning systems, and exterior finishes.

Despite these costs, buying offers the opportunity to build equity over time. Home values in Arizona have shown consistent appreciation, particularly in high-demand areas such as Scottsdale, Phoenix, and Tucson.

Benefits of Buying

Owning a home provides stability, control over your living space, and long-term financial benefits. Homeowners can renovate, landscape, or expand properties without landlord restrictions. Tax advantages, such as mortgage interest deductions, also benefit buyers who itemize deductions on their federal taxes.

Long-term investment potential is a significant advantage. Arizona’s population growth and increasing demand for housing can result in property appreciation. Buyers who purchase in emerging neighborhoods may benefit from equity growth over the years.

Buying also provides predictability in housing costs, especially with a fixed-rate mortgage. Unlike rent, which can increase annually, mortgage payments remain consistent, offering financial stability and planning confidence.

Comparing Renting vs Buying in Arizona

When deciding between renting and buying, several factors should be considered:

- Financial Readiness: Can you afford a down payment, closing costs, and ongoing maintenance? Renting requires less upfront capital.

- Lifestyle Flexibility: Do you anticipate moving within a few years? Renting offers greater mobility.

- Long-Term Investment: Are you seeking equity and long-term appreciation? Buying allows you to invest in your property.

- Market Conditions: Understanding current market trends is crucial. Arizona’s real estate market varies by city, neighborhood, and type of property.

Market Trends in Arizona

Arizona’s rental and housing markets are influenced by population growth, migration trends, and employment opportunities. For a closer look at future rental demand and pricing, the Arizona rental property forecast 2025 provides detailed insights that help renters and investors make informed decisions.

Remote work and lifestyle migration have increased interest in Arizona properties. Many new residents are moving from higher-cost states seeking affordability and quality of life, which directly influences the renting vs buying in Arizona debate.

Neighborhood choice also plays a role in costs. Beginner-friendly neighborhoods in Tucson under $400k offer alternatives for first-time buyers, while urban areas may have higher rental rates due to convenience and amenities.

Flexibility and Lifestyle Considerations

Renting provides flexibility to explore different parts of the state before committing to a purchase. For example, renters may try living in Scottsdale for its urban lifestyle before deciding to buy in the same area. This trial period can prevent costly mistakes and allow for lifestyle alignment.

Buying offers the stability of a permanent home but requires commitment to a location. Buyers should consider long-term employment, family needs, and neighborhood amenities before purchasing. Real estate professionals can provide guidance on neighborhoods that align with both investment potential and lifestyle priorities.

Financing and Affordability

Financing options play a key role in the renting vs buying in Arizona decision. Low interest rates make mortgages attractive, but buyers must still qualify and maintain financial discipline. Renting, on the other hand, requires only monthly payments and deposits, which may be easier for those without substantial savings.

Hidden costs are important to consider. Property maintenance, HOA fees, and repairs can add significantly to monthly costs for homeowners. Renters usually do not face these expenses, but they also do not build equity over time.

FAQs

1. Should I rent or buy if I plan to stay in Arizona for less than 3 years?

Renting is generally better for shorter stays because it avoids large upfront costs and offers flexibility.

2. How does renting vs buying in Arizona affect long-term finances?

Buying builds equity and may offer appreciation, while renting provides short-term cash flow and lower responsibilities.

3. Are mortgage rates favorable in Arizona currently?

Rates vary, but fixed-rate mortgages offer stability compared to rising rent in high-demand areas.

4. Can renters access good neighborhoods in Arizona?

Yes, many desirable neighborhoods offer rental options, though availability may be competitive.

5. Does buying protect against rent increases?

Yes, a fixed-rate mortgage locks in your monthly payments, unlike rental agreements that can rise annually.

Conclusion

Choosing between renting and buying in Arizona requires careful consideration of costs, lifestyle, and long-term goals. Renting provides flexibility, lower upfront expenses, and minimal maintenance responsibilities. Buying offers stability, equity growth, and potential tax benefits.

Arizona’s diverse real estate market, combined with population growth and demand, makes this decision particularly important. By evaluating financial readiness, lifestyle needs, and local market trends, you can make a choice that fits both your current situation and future plans.

Ultimately, understanding renting vs buying in Arizona ensures that newcomers and long-term residents alike can make smart, informed decisions about where and how to live.