The migration pipeline from the Golden State to the Valley of the Sun has been flowing for years, but the landscape of 2026 presents a new set of variables. If you are considering moving to Phoenix from California, you probably already know about the sunshine and the desert landscapes. However, the financial shift involves much more than just a lower mortgage payment. While the “California exodus” remains a popular headline, the actual numbers behind the move have shifted as the Phoenix market matures.

Making this transition successfully requires looking past the surface level savings. To help you plan your relocation with precision, here are the seven critical financial realities of moving to Phoenix from California in 2026.

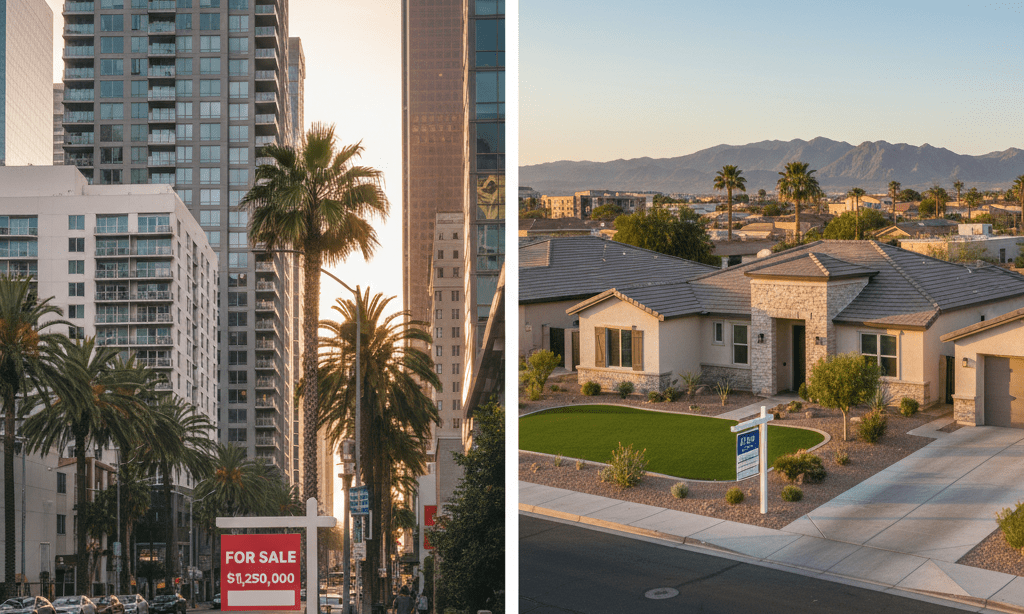

1. The Median Home Price Gap is Closing but Still Substantial

In years past, a homeowner could sell a modest condo in San Jose and buy a mansion in Scottsdale cash. While Phoenix home prices have seen significant appreciation, the value proposition remains the primary driver for families. As of 2026, the median home price in Phoenix sits significantly lower than major California metros like Los Angeles or San Diego.

Even with the market stabilizing, your purchasing power in Arizona often stretches twice as far. However, it is vital to understand that the “bargain” days of the early 2010s are gone. Buyers moving to Phoenix from California should expect a competitive market, especially in high-demand suburbs with top-tier schools. If you are looking to enter the market, exploring off-market rental properties in Phoenix can sometimes reveal opportunities that haven’t yet hit the traditional retail radar.

2. A Dramatic Shift in State Income Tax

One of the most immediate financial “raises” you will receive when moving to Phoenix from California comes from the Arizona Department of Revenue. California is known for its progressive tax brackets that can climb as high as 13.3 percent for top earners. In contrast, Arizona has moved toward a simplified flat tax system.

For 2026, the state offers a highly competitive flat income tax rate of 2.5 percent, representing a massive win for remote workers and high-income professionals. This difference alone can save a middle-class family thousands of dollars annually, effectively offsetting the recent rise in national inflation. When you calculate your take-home pay after moving to Phoenix from California, that extra 4 to 7 percent of your salary staying in your pocket makes a world of difference in your monthly budget.

3. Property Tax Structure and the 1 Percent Rule

California’s Proposition 13 is often cited as a reason to stay in the state, as it limits property tax increases. However, the entry-level property tax rates in Arizona are naturally lower. In the Phoenix metro area, homeowners typically pay an effective property tax rate of around 0.6 to 0.7 percent of the home’s value.

When you are moving to Phoenix from California, you will notice that your total tax bill is often lower even if your new home has a higher assessed value. For a deeper dive into the numbers, checking out the guide on property taxes in Phoenix Arizona will provide the specific breakdowns you need to estimate your monthly escrow payments accurately.

4. The Summer Utility Spike is Real

Many Californians are used to moderate utility bills, especially those coming from coastal areas. One financial reality you must budget for when moving to Phoenix from California is the seasonal swing in electricity costs. While Arizona’s winter utility bills are often negligible, the summer months from June through September require constant air conditioning.

In 2026, with energy rates adjusting, a 2,500 square foot home might see electric bills ranging from $350 to $500 during the peak of July. However, this is often balanced by the fact that heating costs in the winter are almost non-existent. Smart movers often look for homes with “leased solar” or high-efficiency HVAC systems to mitigate these summer spikes.

5. Gasoline and Transportation Savings

While California often leads the nation in gas prices due to high taxes and environmental regulations, Arizona generally sits much closer to the national average. Moving to Phoenix from California usually results in a savings of $1.00 to $1.50 per gallon at the pump.

Additionally, vehicle registration fees in Arizona are based on a declining scale as your vehicle ages, whereas California’s fees can remain high regardless of the car’s age. For those who commute or have multiple vehicles, the transportation savings add up to a significant monthly “bonus.”

6. The “Hidden” Costs of New Habits

Relocating isn’t just about the big bills; it is about lifestyle changes. Moving to Phoenix from California might mean trading your beach parking fees for pool maintenance costs. If your new Arizona home has a private pool, expect to budget for chemicals, professional cleaning, and the extra water usage required to combat evaporation in the desert heat.

Furthermore, homeowners insurance in Arizona has seen adjustments due to the extreme heat’s impact on roofing materials and landscaping. It is always wise to get a quote early in the process so you aren’t surprised at the closing table. Understanding the cost of living in Phoenix Arizona across all categories, not just housing, is the mark of a well-prepared mover.

7. Competitive Edge in the Job Market

Phoenix has evolved into “Silicon Desert,” attracting massive investments from semiconductor and tech giants. For those moving to Phoenix from California, this means the job market is no longer just about tourism and retirement. The influx of high-paying tech and healthcare roles has created a robust economy that supports long-term property value.

If you are a business owner or a remote professional, the lower cost of doing business in Arizona provides a competitive edge. The lack of heavy regulation compared to California allows for more rapid business growth and higher margins.

FAQs

Is it actually cheaper to live in Phoenix than Los Angeles in 2026?

Yes, on average, the total cost of living in Phoenix is approximately 20 to 25 percent lower than in Los Angeles when accounting for housing, taxes, and daily expenses.

How does the 2026 Arizona housing market look for buyers?

The market has moved toward a more balanced state. While inventory has increased compared to the “frenzy” years, well-priced homes in areas like Gilbert, Chandler, and North Phoenix still move quickly.

What should I know about the “Heat Tax”?

The “Heat Tax” refers to the higher electricity bills in the summer and the need for more frequent maintenance on items like car batteries and exterior paint due to sun exposure.

Are schools in Phoenix comparable to California?

Arizona offers a wide variety of school choices, including highly-rated charter and private options. Many families moving to Phoenix from California find that the “Master Planned Communities” offer excellent public schools integrated into the neighborhood design.

Conclusion

Moving to Phoenix from California remains one of the smartest financial moves a family or investor can make in 2026, provided you enter the market with eyes wide open. The combination of a flat income tax, lower property taxes, and a significantly more attainable housing market creates a foundation for long-term wealth building that is increasingly difficult to find in coastal California.

By understanding the realities of seasonal utilities and the maturing real estate landscape, you can ensure that your move to the Valley is a financial success. Whether you are looking for a primary residence or a strategic investment, the opportunities in Phoenix continue to outshine the competition.