The U.S. housing market is evolving rapidly, with each state offering distinct opportunities and challenges for investors.

Among the standout regions, Georgia and Arizona have both become prime destinations for real estate investment in 2025.

While they share similarities in population growth and strong rental demand, their markets function differently.

Understanding the nuances of Georgia vs Arizona real estate will help investors decide which region aligns best with their goals.

Economic Drivers Behind Each Market

Georgia, particularly Atlanta and the surrounding metro areas, has become a hub for technology, film, and logistics.

With corporate relocations and business growth, rental demand continues to climb.

Steady job creation makes Georgia an attractive state for both long-term rentals and fix-and-flip opportunities.

Arizona, on the other hand, thrives on steady population growth, strong tourism, and an influx of remote workers drawn to the climate and lifestyle.

Phoenix remains one of the hottest rental markets in the U.S., while Tucson and the surrounding areas offer more affordable entry points for new investors.

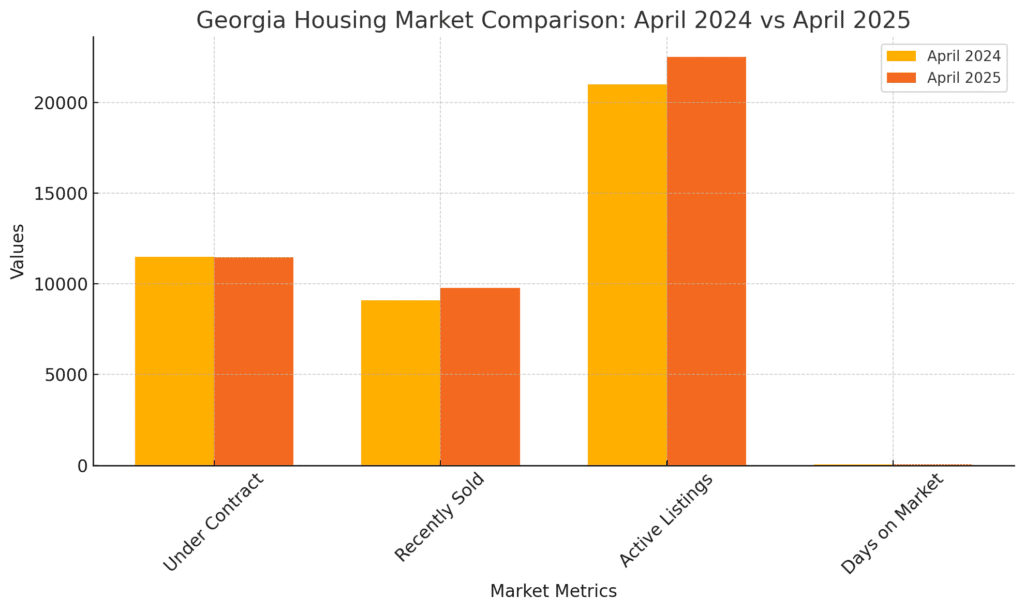

Housing Affordability and Pricing Trends

In 2025, affordability plays a central role in shaping investment decisions. Georgia’s housing prices remain more affordable compared to the national average, particularly outside metro Atlanta. Investors seeking lower entry costs may find suburban and secondary cities highly appealing.

Arizona’s prices have appreciated rapidly in recent years, especially in Phoenix. While this growth benefits current property owners, it creates challenges for first-time investors. However, the rising rental demand ensures strong returns if investors can secure properties before further appreciation.

Rental Market Strength

Both states have thriving rental markets, but for different reasons. Georgia’s diverse economy and younger population mean long-term rental demand is strong in both urban and suburban areas. College towns also add a layer of stability for investors.

Arizona, meanwhile, attracts retirees, remote workers, and seasonal residents. Phoenix, in particular, has seen consistent rental price growth due to limited housing supply and continued in-migration. Investors seeking higher rental yields may find Arizona more lucrative, although competition is stiffer.

Regulatory and Tax Environment

Georgia’s landlord-tenant laws are considered favorable for property owners. Eviction processes are relatively efficient, and property taxes remain moderate, which helps investors maintain profitability.

Arizona also has landlord-friendly regulations, making it easier for investors to manage risks. While property taxes are low compared to national averages, higher insurance premiums in certain areas due to climate risks are something investors must factor into their calculations.

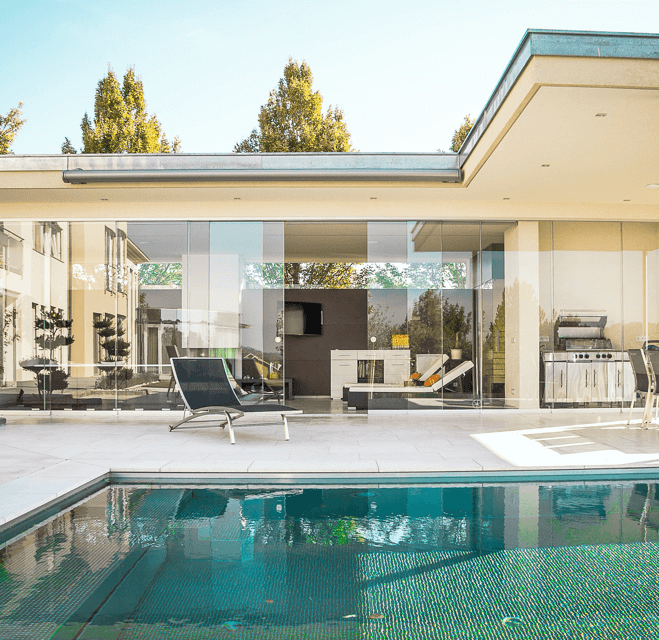

Lifestyle and Location Appeal

Beyond financials, both states offer unique lifestyle perks that fuel housing demand. Georgia offers cultural diversity, proximity to the coast, and a balance of urban and suburban living. Arizona is known for its sunny climate, outdoor lifestyle, and strong appeal to retirees and transplants seeking warmer weather.

Which Market is Better for You?

The decision between Georgia and Arizona ultimately depends on an investor’s strategy. Those looking for lower entry costs, steady appreciation, and strong long-term rental demand may prefer Georgia. Meanwhile, investors focused on higher cash flow, rapid growth, and short-term appreciation might lean toward Arizona.

If you are considering expanding your portfolio in these states, working with a trusted local partner makes the difference. Heritage Capital & Real Estate can guide you through opportunities, from identifying hidden deals to navigating transactions. Whether you are looking to buy a rental property or sell an existing one, expertise and local knowledge ensure your strategy aligns with market conditions.

Conclusion

Both Georgia and Arizona remain strong contenders for real estate investment in 2025. While Georgia offers affordability and long-term stability, Arizona provides high-growth potential and strong rental yields. Evaluating Georgia vs Arizona real estate through the lens of your personal investment goals will help you choose the right market. With the right guidance, either state can provide a profitable path toward building wealth through real estate.

FAQs

1. Why compare Georgia vs Arizona real estate in 2025?

Both states are among the top-performing real estate markets this year, offering opportunities for investors seeking growth, rental income, or portfolio diversification. Comparing them helps investors align strategies with state-specific benefits.

2. Which state offers more affordable entry points?

Georgia tends to be more affordable, especially in areas outside of Atlanta. Arizona, particularly Phoenix, has seen rapid appreciation, raising entry costs but also offering strong rental yields.

3. Which market is better for rental income?

Arizona’s tight housing supply and steady migration trends make it highly competitive for rental income. Georgia, however, offers stable rental demand across urban, suburban, and college-town markets.

4. Are landlord laws favorable in both states?

Yes. Both Georgia and Arizona are considered landlord-friendly, though local regulations and insurance considerations should always be factored in before investing.

5. How do I decide which market suits my goals?

If your focus is on affordability and long-term appreciation, Georgia may be a better option. If you seek high rental yields and are prepared for higher entry costs, Arizona could be the right fit.