The allure of the Arizona desert has never been stronger, but as the housing market evolves, many people are finding that the traditional route to homeownership is becoming increasingly competitive. This has led a growing number of residents and savvy entrepreneurs to look toward a different kind of opportunity. Entering the world of renovation can be both a creative outlet and a massive financial win if you know what to look for. Whether you are a first-time buyer hoping to build sweat equity or a seasoned pro looking for your next project, having a solid strategy is the only way to ensure success in the Valley of the Sun.

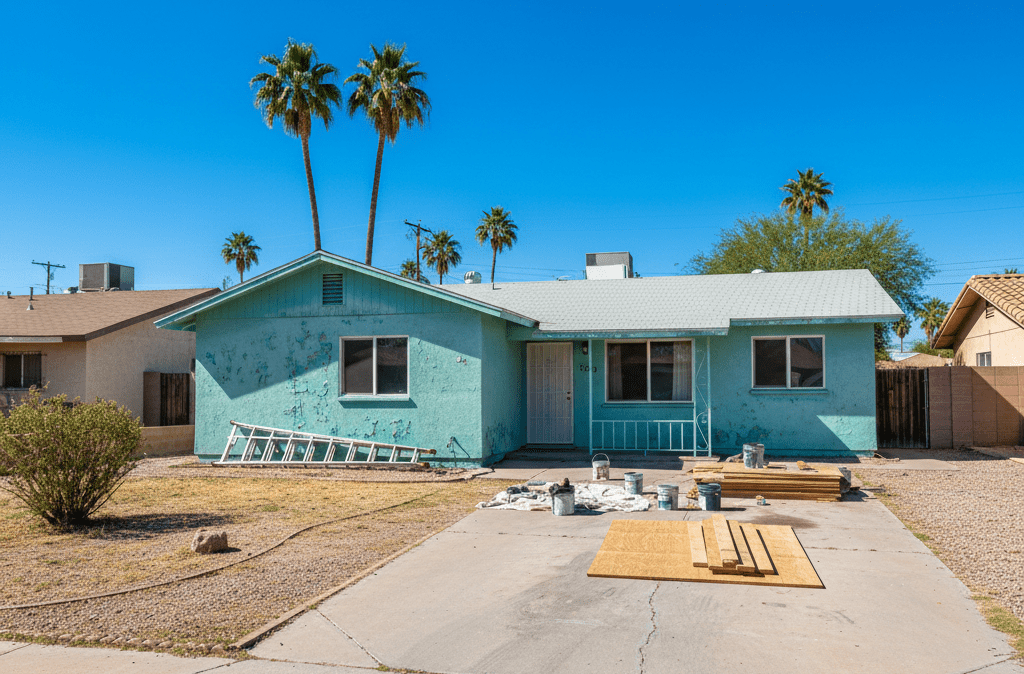

Navigating the local landscape requires more than just a toolbelt; it requires a deep understanding of neighborhood dynamics, renovation costs, and the specific quirks of desert architecture. This Phoenix fixer-upper homes guide is designed to take you through the essentials of identifying, evaluating, and ultimately transforming a property that others might overlook. In a city where new construction is pushing further into the outskirts, finding a “diamond in the rough” in an established neighborhood can offer a lifestyle and value that is hard to replicate elsewhere.

Why Phoenix is a Prime Spot for Renovations

Phoenix has long been a hub for growth, but the current market in 2026 shows a unique trend: a return to stability. With mortgage rates hovering in the low-to-mid 6% range, buyers have more breathing room to negotiate than they did during the frantic spikes of previous years. The city’s diverse housing stock, ranging from mid-century modern gems in Central Phoenix to sprawling ranch styles in the East Valley, provides a perfect canvas for those willing to put in the work.

The primary advantage of following a Phoenix fixer-upper homes guide approach is the ability to buy into a desirable zip code at a lower entry point. While others are bidding on move-in-ready homes with premium price tags, you can focus on properties that need cosmetic love but possess strong “bones.” This strategy is particularly effective in a market where inventory is finally starting to loosen up, giving you more options to choose from without the pressure of a 24-hour bidding war.

Identifying the Right Neighborhoods

In real estate, location is the one thing you cannot change. You can replace a roof, gut a kitchen, and landscape a yard, but you cannot move a house three blocks closer to a better school or a quieter street. When searching for a project, look for areas that are currently undergoing revitalization.

Suburbs that were once overlooked are now becoming hotspots for young professionals and families. For those interested in long-term gains, looking at an investors guide off-market rental properties in Phoenix can provide a competitive edge. Off-market deals often include fixer-uppers that haven’t hit the major listing sites yet, allowing you to avoid the general public’s competition.

Central Phoenix and the Coronado Historic District are famous for their character-filled homes that often need modern electrical or plumbing updates. Meanwhile, areas like South Phoenix are seeing a wave of new infrastructure that makes buying a fixer-upper there a smart play for future appreciation. A thorough Phoenix fixer-upper homes guide always emphasizes that a great house in a bad area is a liability, but a neglected house in a great area is a goldmine.

Budgeting for the Reality of Renovations

One of the biggest mistakes newcomers make is underestimating the cost of materials and labor. In 2026, the average whole-home renovation in the Phoenix metro area typically ranges from $40,000 to $130,000, depending on the square footage and the quality of finishes. Cosmetic updates like paint, flooring, and new fixtures are the most cost-effective, while “unseen” repairs like HVAC systems, foundation work, or sewer line replacements can quickly eat through a budget.

When using this Phoenix fixer-upper homes guide to plan your finances, always include a contingency fund of at least 15% to 20%. In older Phoenix homes, you might peel back the drywall only to find outdated “knob and tube” wiring or plumbing that doesn’t meet current codes. Knowing these hidden costs every home buyer in Phoenix should know before closing will save you from a “money pit” scenario. It is better to pass on a deal than to be stuck with a project that costs more to fix than the home will eventually be worth.

The Critical Importance of Inspections

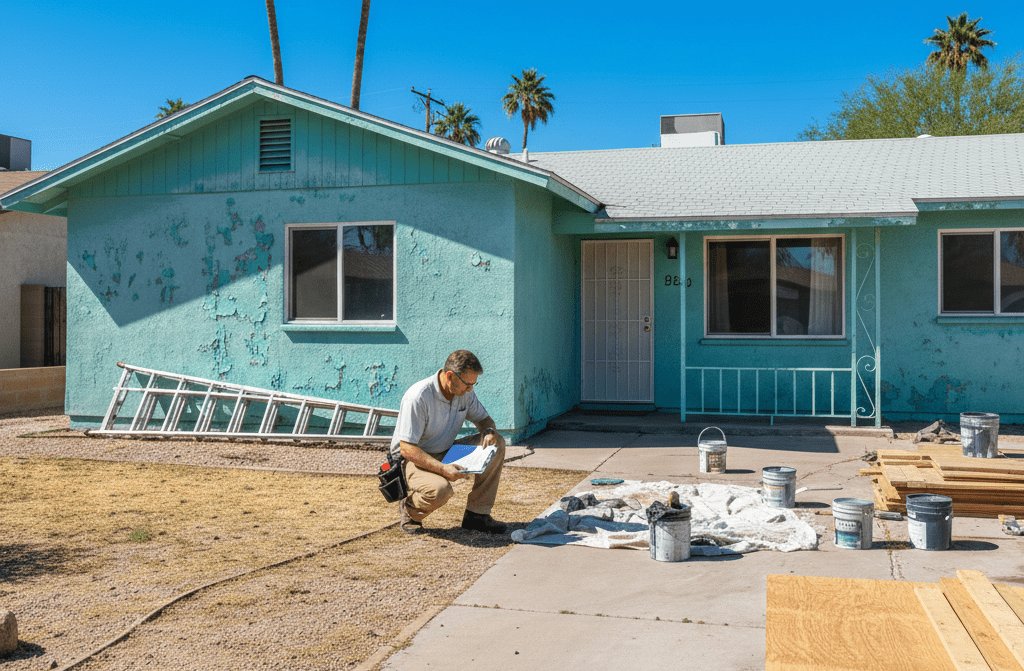

You should never buy a fixer-upper based on a “gut feeling” or a walk-through alone. A professional home inspection is your most powerful tool. In Arizona, inspectors pay special attention to the roof (due to intense sun damage) and the foundation (due to shifting desert soils). Termite inspections are also a non-negotiable part of the process in the Southwest.

A comprehensive Phoenix fixer-upper homes guide suggests being present during the inspection. Ask the inspector to point out which issues are “structural” and which are “cosmetic.” For example, a cracked tile floor might just be an old installation issue, but a crack in the stem wall of the foundation could signal a much larger problem. If the house has a pool, make sure it receives a separate specialized inspection, as resurfacing and equipment repairs can add thousands to your initial budget.

Financing Your Project

Traditional mortgages can sometimes be difficult to secure for homes that are in poor condition. Lenders typically want to ensure the property is “habitable” before they fund the loan. This is where renovation-specific loans come into play. Programs like the FHA 203(k) or Fannie Mae HomeStyle allow you to bundle the purchase price and the renovation costs into a single monthly payment.

Beyond the construction itself, understanding the long-term carrying costs is essential for both residents and investors. Property taxes in Maricopa County are relatively stable, but a major renovation can trigger a reassessment of your home’s value. To plan your budget accurately, it is helpful to consult the Maricopa County Assessor’s Office, which provides tools to search property valuations and understand how improvements might affect your future tax bills. Knowing these numbers upfront allows you to calculate your potential return on investment with much greater precision.

For those looking at this as a business venture, understanding the nuances of the local market is vital. You might find that Phoenix real estate investment strategies vary significantly between a quick “fix and flip” and a “buy and hold” rental strategy. Investors often use hard money loans or private lines of credit to move quickly on distressed properties, then refinance into a traditional mortgage once the repairs are complete and the home’s value has increased.

Avoiding Common Renovation Pitfalls

The “HGTV effect” has convinced many that a full kitchen remodel takes three days and costs five dollars. In reality, a Phoenix fixer-upper homes guide must be grounded in the fact that renovations take time. Permitting in Maricopa County can sometimes be a bottleneck, especially for structural changes or additions.

Common pitfalls include:

- Over-improving for the neighborhood: Don’t put $100,000 into a kitchen if the highest-priced home on the block only sold for $400,000.

- Ignoring the curb appeal: In the Phoenix heat, landscaping needs to be both beautiful and drought-resistant. Ignoring the exterior is a mistake that can turn off future buyers.

- DIY-ing the wrong things: While painting is a great DIY task, leave the electrical and gas lines to the licensed professionals.

The Future of the Phoenix Market

As we look toward the remainder of 2026, the Phoenix market remains resilient. The influx of tech jobs and a younger workforce keeps demand for housing high. This means that if you follow a disciplined Phoenix fixer-upper homes guide, your chances of building significant equity are very good. The “lock-in effect,” where current homeowners are hesitant to leave their low-interest rates, continues to limit the supply of move-in-ready homes, making renovated properties even more valuable to the average buyer.

The key is to remain patient. The best deals often require looking past the lime-green carpet or the overgrown yard to see the potential underneath. By combining a solid financial plan with a realistic timeline, you can turn a neglected property into a beautiful home or a high-performing investment asset.

Frequently Asked Questions

Is it cheaper to buy a fixer-upper or a new build in Phoenix?

Generally, a fixer-upper in an established neighborhood has a lower purchase price, but after renovation costs, the total investment might be similar to a new build. The advantage of the fixer-upper is often a better location and a larger lot compared to new developments on the city’s outskirts.

What are the best types of repairs for increasing home value?

Cosmetic updates such as fresh interior and exterior paint, new flooring, and updated kitchens/bathrooms offer the highest return on investment. Improving energy efficiency with new windows or better insulation is also highly valued in the Phoenix climate.

How long does a typical Phoenix home renovation take?

A cosmetic refresh can take 4 to 8 weeks. A major renovation involving structural changes, new plumbing, and electrical work can take 4 to 9 months, depending on the speed of permitting and contractor availability.

Do I need a permit for all renovations in Phoenix?

Not for everything. Minor repairs, painting, and flooring usually don’t require permits. However, anything involving structural changes, new electrical circuits, or moving plumbing lines will almost certainly require approval from the city.

Conclusion

Embarking on a renovation journey is one of the most rewarding ways to participate in the Arizona real estate market. By following a structured Phoenix fixer-upper homes guide, you move from being a hopeful searcher to a strategic owner. The process requires a balance of vision and pragmatism, you must see the potential in a crumbling house while respecting the hard data of your budget and the neighborhood’s ceiling. Whether you are aiming to create your dream home or looking to build a portfolio, the opportunities in Phoenix are vast for those willing to roll up their sleeves. Stay focused on the fundamentals, hire the right professionals, and remember that every great home was once just a vision and a bit of hard work.