Buying a home in Phoenix is exciting. The weather is warm, the lifestyle is active, and neighborhoods offer everything from modern builds to established communities. But once the keys are in your hand, the real question starts to matter: how much does it actually cost to live here month to month?

Understanding the Phoenix cost of utilities and home expenses helps new homeowners avoid surprises and budget with confidence. Mortgage payments are only part of the equation. Utilities, maintenance, insurance, and local fees all play a role in what homeownership truly costs in the Valley.

This guide breaks down what new homeowners should expect, how costs vary by home type and season, and what you can do to manage expenses effectively.

Why Home Expenses in Phoenix Are Different Than Other Cities

Phoenix has a unique climate, and that directly impacts household costs. Long, hot summers mean air conditioning is not optional. Water usage matters more here than in cooler or wetter states. At the same time, winters are mild, which helps offset some heating costs.

When evaluating the Phoenix cost of utilities and home expenses, homeowners quickly learn that seasonal patterns matter. Expenses rise in summer, level out in fall, and drop slightly in winter.

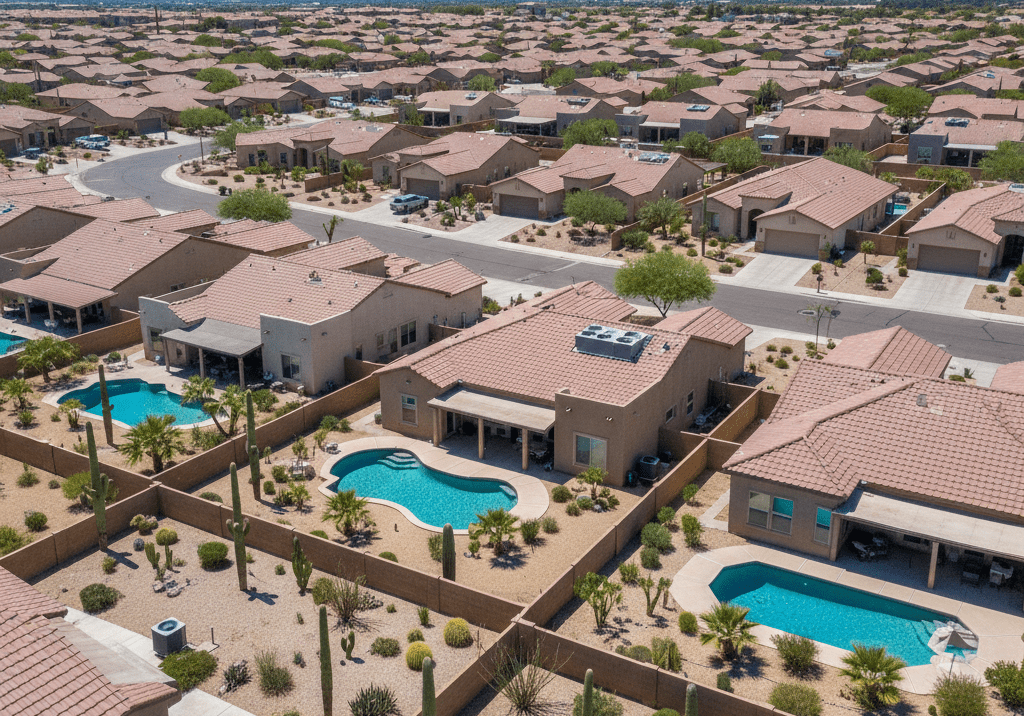

Another factor is housing style. Single-family homes, especially those with pools or large yards, naturally cost more to maintain than condos or townhomes.

Average Utility Costs for Phoenix Homeowners

Utilities are often the biggest non-mortgage expense. Here is how they typically break down.

Electricity Costs

Electricity is the largest contributor to the Phoenix cost of utilities and home expenses. Air conditioning runs heavily from May through September, and summer bills can surprise first-time buyers.

Most homeowners can expect:

- Higher electricity bills in summer months

- Lower usage during winter due to mild temperatures

- Noticeable savings in energy-efficient or newer homes

Homes with older HVAC systems or poor insulation often see significantly higher costs.

Water and Sewer Bills

Water usage is another major factor. Landscaping, irrigation systems, and pools all increase monthly bills.

Average water expenses depend on:

- Lot size

- Landscaping type

- Pool ownership

- Household size

Many homeowners switch to desert-friendly landscaping to reduce water costs over time.

Homeowners should understand how water usage is billed in Phoenix, as it affects the overall Phoenix cost of utilities and home expenses. The City of Phoenix publishes its official water and sewer rate schedule, which shows how fixed monthly service charges and usage-based fees change with meter size and season. These rates help homeowners estimate monthly bills and plan for seasonal variations in water use.

Natural Gas

Gas is usually less expensive in Phoenix compared to colder regions. It is mainly used for cooking, water heating, and occasional winter heating.

For most homeowners, gas is one of the smaller components of the Phoenix cost of utilities and home expenses, especially in well-insulated homes.

Internet, Trash, and Everyday Services

Beyond the major utilities, smaller services still add up.

- Internet and cable vary by provider and speed

- Trash and recycling are often billed through the city

- HOA fees may cover some services in planned communities

These costs are stable throughout the year, making them easier to budget for compared to seasonal utilities.

Maintenance Costs Every Phoenix Homeowner Should Expect

Maintenance is where many first-time homeowners underestimate expenses.

HVAC Maintenance

Your air conditioning system works hard in Phoenix. Regular servicing is essential.

Typical costs include:

- Annual inspections

- Filter replacements

- Occasional repairs

Skipping maintenance often leads to higher repair bills and increased energy usage.

Roof and Exterior Wear

The sun is intense in Phoenix. Roofs, paint, and exterior materials age faster here than in milder climates.

Planning for routine upkeep is an important part of managing the Phoenix cost of utilities and home expenses long term.

Landscaping and Pool Care

Homes with yards or pools require ongoing attention. Monthly landscaping services and pool maintenance are common expenses that should be factored into your budget.

Property Taxes and Insurance in Phoenix

While utility bills fluctuate, taxes and insurance are more predictable.

Property Taxes

Arizona property taxes are relatively moderate compared to many states. However, taxes can vary by area and property value.

Understanding your full ownership costs often starts with reviewing broader housing expenses, which are explained in detail in this guide on the cost of living in Phoenix, Arizona, including housing and utilities.

Homeowners Insurance

Insurance costs depend on:

- Home value

- Location

- Coverage level

- Pool or additional structures

While Phoenix has fewer natural disasters than some regions, coverage is still a necessary part of the overall Phoenix cost of utilities and home expenses.

Hidden Homeownership Costs New Buyers Miss

Some costs do not show up until after closing.

These may include:

- Appliance repairs

- HOA special assessments

- Increased utility deposits

- Small repairs during the first year

Planning for these costs early reduces stress and improves long-term affordability.

How Home Type Impacts Monthly Expenses

The Phoenix cost of utilities and home expenses varies significantly by property type.

Single-Family Homes

These usually have:

- Higher utility bills

- Landscaping costs

- More maintenance responsibility

They offer privacy and space but come with higher monthly obligations.

Condos and Townhomes

Condos often include:

- Lower utility usage

- Shared maintenance through HOA fees

- Less exterior responsibility

While HOA fees exist, they often replace other maintenance costs.

New Construction Homes

Newer homes tend to be more energy efficient. Updated insulation, windows, and HVAC systems can noticeably lower the Phoenix cost of utilities and home expenses over time.

If you are considering a newer property, this guide on buying new construction homes in Arizona.

Seasonal Budgeting Tips for Phoenix Homeowners

Smart budgeting helps smooth out monthly fluctuations.

- Set aside extra funds for summer electricity bills

- Schedule HVAC maintenance before peak heat

- Use programmable thermostats

- Monitor water usage closely in summer months

Homeowners who plan seasonally often find the Phoenix cost of utilities and home expenses much easier to manage.

Energy Efficiency Improvements That Pay Off

Investing in efficiency can reduce costs significantly.

Popular upgrades include:

- Solar panels

- High-efficiency HVAC systems

- Energy-efficient windows

- Smart thermostats

While upgrades require upfront investment, they often reduce monthly expenses and increase home value.

How Location Within Phoenix Affects Costs

Neighborhoods matter. Older areas may have larger lots and mature landscaping, which increases water usage. Newer developments often feature energy-efficient designs and smaller yards.

Utility rates remain similar across the city, but usage patterns differ. This means the Phoenix cost of utilities and home expenses can vary even between homes priced similarly.

Planning Your First Year as a Phoenix Homeowner

The first year usually costs more due to:

- Initial repairs

- Furniture purchases

- Minor upgrades

- Utility adjustments

Having a realistic budget helps new homeowners settle in without financial strain.

Understanding the Phoenix cost of utilities and home expenses ahead of time makes the transition smoother and more predictable.

FAQs

Is electricity really the biggest expense for Phoenix homeowners?

Yes. Air conditioning drives electricity usage, especially during summer months.

Are Phoenix utility costs higher than the national average?

Electricity costs can be higher during summer, but lower heating costs help balance annual expenses.

Do pools significantly increase monthly expenses?

Pools add water, electricity, and maintenance costs, but proper care can help control spending.

Are new homes cheaper to maintain?

Generally yes. Newer systems and materials often lower maintenance and utility costs.

Can solar panels reduce monthly bills?

Yes. Many homeowners see long-term savings with solar, especially during peak summer usage.

Conclusion

Owning a home in Phoenix comes with clear advantages, but understanding the full financial picture is essential. The Phoenix cost of utilities and home expenses goes beyond monthly bills and includes maintenance, insurance, and long-term upkeep.

When homeowners plan ahead, budget seasonally, and invest in efficiency, living in Phoenix can be both comfortable and financially manageable. Knowing what to expect allows you to enjoy your home without unexpected stress.