Phoenix has long been one of the most dynamic real estate markets in the United States. Its mix of strong population growth, rising job opportunities, and appealing lifestyle makes it a magnet for both local and out-of-state investors. As we move through 2025, understanding the trends shaping the phoenix real estate investment landscape is essential for anyone planning to buy, sell, or expand their portfolio in the city.

Phoenix continues to evolve from a regional housing hotspot to a nationally recognized investment hub. From the revitalization of downtown neighborhoods to large-scale suburban developments, this city offers opportunities for every investor type — from first-time buyers to experienced property managers.

The Market Landscape in 2025

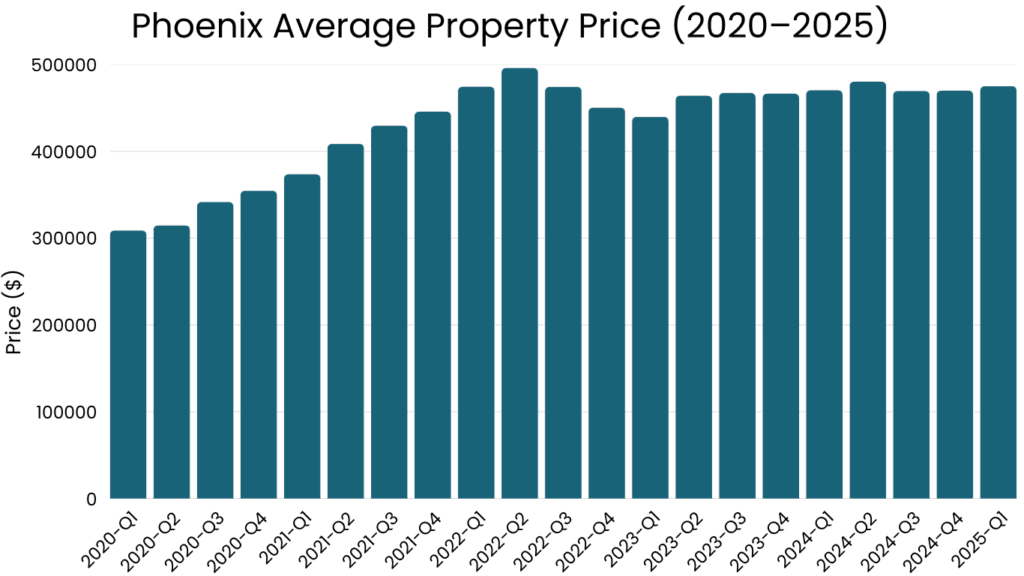

Phoenix’s real estate market remains competitive but has shown signs of steadying after the intense price surges of previous years. Median home prices are stabilizing, and demand is being driven by new residents relocating for jobs, retirees seeking warmer climates, and companies expanding operations in Arizona’s growing tech and healthcare sectors.

While growth may have cooled slightly compared to the peak of the pandemic boom, 2025 presents a more balanced environment. Investors can expect slower appreciation rates but greater sustainability in returns. Rental markets remain strong, bolstered by limited housing supply and consistent population inflow.

Experts believe that Phoenix will continue to experience steady population growth through the end of the decade. This consistent demand underpins property values and ensures that phoenix real estate investment remains a viable long-term opportunity.

Why Phoenix Appeals to Investors

There are several key reasons why Phoenix continues to attract both domestic and international real estate investors. The city’s affordability compared to coastal markets, combined with favorable tax conditions and a business-friendly climate, makes it ideal for investment.

Phoenix also benefits from Arizona’s diverse economy. With expanding industries such as technology, manufacturing, and renewable energy, job creation continues to fuel housing demand. For buyers looking to enter the market, this mix of growth and stability is appealing, particularly for those planning to buy property in promising neighborhoods with long-term potential.

Additionally, Phoenix’s urban development projects are reshaping its skyline and suburbs. Mixed-use communities, modern apartment complexes, and new infrastructure are transforming how residents live and work. These improvements not only attract more buyers but also boost property appreciation in surrounding areas.

Rental Market Insights

Investors focused on rental income will find Phoenix especially appealing in 2025. Rental demand continues to outpace supply, keeping occupancy rates high and returns strong. Areas near universities, business centers, and new tech corridors are particularly lucrative.

Long-term rentals remain a solid option, but short-term rentals have also gained popularity, thanks to Phoenix’s steady flow of tourists, seasonal visitors, and business travelers. Investors should remain mindful, however, of evolving short-term rental regulations in specific districts.

The city’s ongoing population growth and limited new housing construction create a favorable environment for landlords seeking reliable cash flow and appreciation potential.

Affordability and Financing Trends

While home prices have risen compared to pre-2020 levels, Phoenix remains more affordable than many other U.S. metros. This relative affordability attracts investors from states like California, Washington, and New York, who are seeking better value and higher rental yields.

In 2025, mortgage rates will have moderated after the sharp increases of past years, making financing more accessible again. Many local lenders now offer flexible options for investors and first-time buyers. With careful budgeting and market analysis, Phoenix still represents one of the best-value metropolitan areas in the country.

Working with local real estate investment experts ensures that investors can identify neighborhoods poised for growth while navigating lending options effectively.

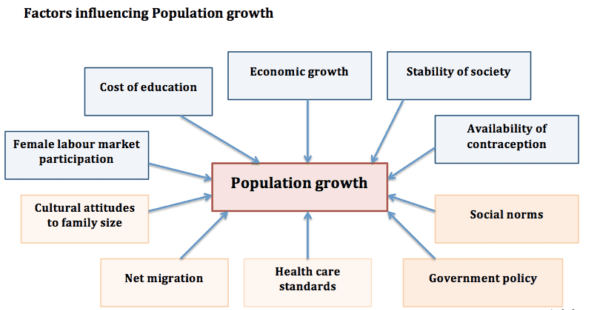

The Role of Population Growth

Population growth remains the strongest driver of Phoenix’s housing demand. The city attracts new residents due to its employment opportunities, warm climate, and lower overall living costs. This steady migration supports property values and contributes to rental market resilience.

Furthermore, remote work has encouraged many professionals to relocate to Arizona, where they can enjoy larger homes, lower costs, and year-round sunshine. As this trend continues, suburban areas around Phoenix, such as Gilbert, Chandler, and Peoria, are seeing increased housing activity.

For investors, this expanding suburban growth opens up new opportunities to purchase homes with long-term value and rising equity potential.

Emerging Hotspots for 2025

Several neighborhoods are gaining attention among investors this year. Downtown Phoenix continues its transformation into a vibrant business and entertainment district, with mixed-use developments attracting both young professionals and retirees.

Meanwhile, suburbs like Mesa and Surprise offer lower entry prices and consistent rental demand. West Valley communities are also gaining traction thanks to major infrastructure projects and expanding industrial zones.

Investors seeking balanced returns should focus on areas with strong school districts, access to highways, and growing employment centers. These factors tend to deliver higher appreciation and tenant stability.

Future Outlook: Sustainability and Innovation

Phoenix’s growth is increasingly tied to sustainable development and technology integration. Developers are prioritizing energy-efficient homes, smart-building technology, and environmentally conscious community designs. This focus aligns with buyer preferences and adds long-term appeal to investment properties.

Moreover, Phoenix’s ongoing investment in public transportation, water management, and urban infrastructure supports continued real estate expansion. As the region’s population surpasses new milestones, these initiatives will play a crucial role in maintaining livability and property demand.

Challenges to Watch

While the market remains healthy, investors should be aware of potential challenges. Rising insurance costs due to climate considerations, water resource management, and property tax fluctuations could affect certain neighborhoods differently.

Additionally, increased competition from institutional investors has made some property segments more competitive. However, individual buyers who plan strategically and rely on local expertise can still find strong opportunities for returns.

If you’re evaluating investment properties or want to explore your options, don’t hesitate to get in touch with our experienced team. We’ll help you align your goals with Phoenix’s best real estate opportunities for 2025 and beyond.

Long-Term Investment Potential

Despite short-term fluctuations, the long-term outlook for phoenix real estate investment remains positive. Its combination of affordability, steady migration, and economic growth ensures resilience even in changing national market conditions.

Property values are expected to rise steadily over the next decade, supported by continuous infrastructure investment and job creation. Investors focusing on buy-and-hold strategies or income-producing rentals will likely benefit from this sustained upward trend.

Whether you are a local buyer or relocating investor, working with knowledgeable professionals can make a significant difference in your success. Strategic timing, area selection, and financial planning will help you make the most of the Phoenix market in 2025.

Conclusion

Phoenix continues to stand out as a premier destination for real estate investors. With a strong economy, growing population, and manageable entry costs, it remains a top-tier market for sustainable returns. While national housing trends may shift, the fundamentals supporting Phoenix’s growth are solid.

By focusing on local trends, understanding your financing options, and staying informed about emerging neighborhoods, you can make more informed decisions for your real estate portfolio. Whether your goal is appreciation, rental income, or long-term wealth creation, Phoenix offers the perfect environment for success.

FAQs

1. Is Phoenix still a good place for real estate investment in 2025?

Yes, Phoenix remains one of the strongest real estate markets in the U.S., supported by population growth and a robust local economy.

2. What types of properties perform best in Phoenix?

Single-family homes and modern apartments in well-connected suburbs yield the best long-term results.

3. Are rental properties profitable in Phoenix?

Yes, rental demand remains high due to ongoing population growth, job creation, and limited housing supply.

4. What risks should investors consider?

Investors should monitor insurance costs, local regulations, and market competition, but overall stability remains high.

5. How do I start investing in Phoenix real estate?

Work with a trusted agent familiar with Phoenix’s neighborhoods and market trends to identify the best opportunities.